Amortization expense formula

Amortization of loans and amortization of assets. COGS is the aggregate of cost of production that is directly assignable to the production process which primarily includes raw material cost direct labor cost and.

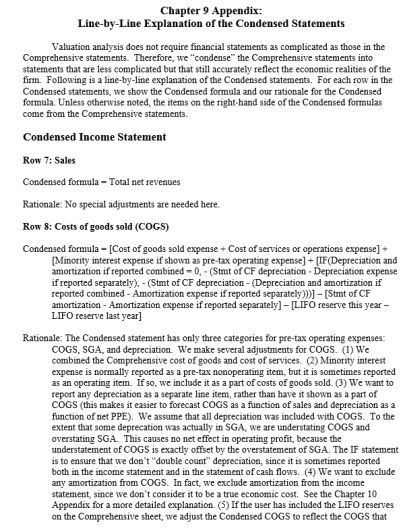

Income Statement Template 40 Templates To Track Your Company Revenues And Expenses Template Sumo Income Statement Statement Template Income

The term is used for two separate processes.

. An amortization schedule is a table detailing each periodic payment on an amortizing loan typically a mortgage as generated by an amortization calculator. Amortization expense is the write-off of an intangible asset over its expected period of use which reflects the consumption of the asset. Finally the formula for EBITDA can be derived by adding interest step 2 tax step 3 and depreciation amortization step 4 to the net income step 1 as shown below.

Amortization is the practice of spreading an intangible assets cost over that assets useful life. In this case you will calculate monthly amortization. In business amortization refers to spreading payments over multiple periods.

Depreciation is the expensing a fixed asset as it is used to reflect its anticipated deterioration. The principal is the current loan amount. The formula for the operating expense can be derived by using the following steps.

Youll need the principal amount and the interest rate. It is also easily available in the income statement. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan.

Firstly determine the COGS of the subject company during the given period. To calculate operating expense you simply add all of your operating expenses together. How to calculate operating expense.

The EBITDA Earnings before interest tax depreciation and amortization formula as the name indicates is the calculation of the companys profitability which can be derived by adding back interest expense taxes depreciation amortization expense to net income. Next determine the depreciation amortization expense on the tangible and intangible assets respectively. How to Create a Cost Leadership Strategy.

The accumulated amortization account appears on the balance sheet as a contra account and is paired with and positioned after the intangible assets line itemIt is not common to report accumulated. A standard formula might look like this. It also refers to the spreading out.

Gather the information you need to calculate the loans amortization. In the latter case it refers to allocating the cost of an intangible asset over a period of time for example over the course of a 20-year patent term 1000 would be recorded each year as an amortization. To calculate amortization you also need the term of the loan and the payment amount each period.

In this article you will see it described as both an operating expense and applied separately from other operating expenses. A portion of each payment is for interest while the remaining amount is applied towards the. Amortization refers to the process of paying off a debt often from a loan or mortgage over time through regular payments.

Cash Flow From Operating Activities Learn Accounting Cash Flow Statement Accounting Education

Ebitda Formula Accounting Education Finance Printables Saving Money Budget

Fcff Formula Examples Of Fcff With Excel Template Cash Flow Statement Excel Templates Formula

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

How To Amortize Intangible Assets Http Www Svtuition Org 2014 06 How To Amortize Intangible Assets Ht Accounting Education Learn Accounting Intangible Asset

Times Interest Earned Formula Advantages Limitations Accounting And Finance Financial Analysis Accounting Basics

Accelerated Depreciation Method Accounting Basics Accounting And Finance Accounting Education

Depreciation Turns Capital Expenditures Into Expenses Over Time Income Statement Income Cost Accounting

Loan Payment Spreadsheet Budget Spreadsheet Spreadsheet Mortgage Amortization Calculator

Accounting Equation Chart Cheat Sheet In 2022 Accounting Accounting Education Payroll Accounting

Depreciation Vs Amortization Top 9 Amazing Differences To Learn Accounting Notes Accounting Basics Instructional Design

Pin On Investing Investment Clubs Taxes

Myeducator Accounting Education Accounting Accounting Classes

Ebit Vs Ebitda Differences Example And More Bookkeeping Business Accounting Education Financial Analysis

Operating Cash Flow Ocf Cash Flow Statement Cash Flow Budget Calculator

Ifrs 16 Transition Series For Lessees Example 2 Transitional Amortization Schedule Journal Entries

The Freedom Formula How To Turn 244 000 Into 1 4m In 14 Years Investing Architect Investing Debt Service The Freedom